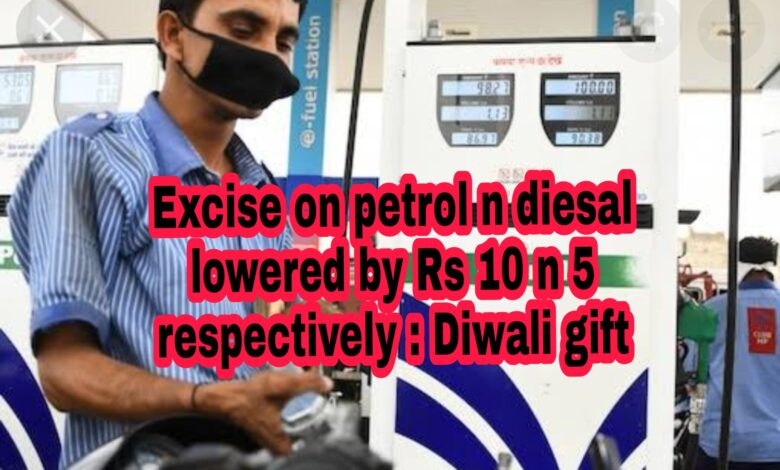

After 14 times increase in petrol and 17 times spike in diesal rates in October, Rs. 10 n Rs 5 decreased on excise duty respectively on Diwali

After enhancing the petrol and diesal prices manifold with the petrol price going to Rs. 110 and diesal price to Rs. 98.42 in Delhi and similarly in all the states of the country adversely affecting the inflation with skyrocketing price rise of various essential commodities, the government has announced Deepawali gift of reducing excise duty of petrol and diesal by Rs. 5 and 10 respectively on per litre from 4 th November, the day of Deepawali. According to the tweet of ANI the government has announced this concession on the occasion of pious Deepawali. Over more than 1.50 crore government employees had been given a Diwali gift earlier making them jubilant.

There have been fourteen times spurt in Petroleum and diesal prices during the month of October in twenty one days with petrol and diesal prices crossing Rs 100 in several states of the country. The government earns maximum revenue through petroleum n diesal and about seventy percent of taxes are imposed on petrol and diesal by central and state governments.

The rates of per cylinder domestic gas has also been increased with cylinder in Jaipur costing Rs one thousand and Rs 899.50 in Delhi and Mumbai and Rs. 926 in Calcutta n Rs. 915.20 in Chennai.

Even the RBI Governor Shaktikant Dass who got an extension of three years has in his speech in October urged the Union government indirectly to cut massive tax on petroleum products.

He said that efforts to contain cost push pressures through a calibrated reversal of the indirect taxes on fuel to contribute to the more sustained lowering of inflation and an anchoring of inflation expectations.

Kindly recall that the Union government has earned 300% more i. e. Rs. 2.94 lakh crores during the fiscal year 2020-21. In 2014-15, the central government collected Rs 29,279 crores from excise duty on petrol and Rs 42,881 crores from diesal when Modi came to power. In the first ten months the collection on Petrol and Diesal in the first ten months during the fiscal year 2020-21, it rose to 2lakh97 thousand crores. If we assess the collection with excise duty the union government in 2014-15 collected Rs 7.158 crores which has enhanced to Rs. 2.958 lakh crores in April 2020 to January 2021period. Conclusively the total revenue collected through taxes on diesal, petrol and natural gas has gone up by 12.2% compared to the 5.4% in 2014- 15.

1. There is bound to be rise in fuel prices due to shortages in fossil fuels which are fast depleting globally

Europe is facing a crises while in USA the rates are highest in the past decade while.China has started rationing of electricity. Oil producing nations especially the middle east countries know very well that they wont be able to survive in the coming 30 years and henseforth they have also shifted their economic focus from crude oil to other products and have opened up their economy greatly as well as relaxed their rigid norms to survive in the world..

2. What was the need for UPA govt to sign oil bonds which lasts for years and now even if the Modi govt wishes to , it cannot buy oil from other nations at cheaper rates

3. Why is the opposition all the time opposing to bring petrol under GST? After careful analysis one finds that the states are charging very high tax rates and at the same time wants the centre to keep rates reduced ! When will this hypocracy come to an end?

4. Centre is already working towards green energy and production of ethanol to meet future needs

5. Covid has led to futher enhancement of crises

6. Opposition in India should stop petty politics as they themselves are responsible by signing oil bonds and now blaming centre for fuel crises